What a difference a day makes. Just yesterday, things were looking up for the world... errr, scratch that. Yesterday marked a tipping point for Greece and the other PIIGS as highlighted in yesterday's article. Call it a confirmed point of no return. What's the diagnosis since then? The 10yr Greek bond went from 14.82% to 15.09% today. The 10yr Portuguese bond went from 9.31% to 9.71%. The Spanish 10yr remained relatively stable, going up only a fraction of the others; no doubt talk about China supporting Spain to the end (like they did Greece) is keeping Spain stable, for now. And while the US still remains the best house on the worst block in the worst city, the dollar's slow death continues. Call it a death by a thousand fiat paper cuts, cooked up by Dr. Deficit and Co. Yet, stocks remain oblivious to the scope of the dire global situation and continue to sour sore soar to the sky on light volume. It should be obvious to everyone if your purchasing power is decreasing faster than stock prices are rising, what's the point in holding stock anyways? Worse still, you end up paying taxes on those so-called "gains" you made, so you end up with a big fat net negative loss after adjusting for purchasing power. Just stating the obvious.

Which brings us back to why silver and gold are skyrocketing to the moon, with no end in sight. Silver blasted through the $45 level and went straight up to $46.20. Gold holding steady at $1505. But the show is just getting started - the globalized economy is now in such a flimflam downward perpetual spiral, that every and any move leads to the same exact outcome. You can see where this is going. Euros, Yen, Pounds, Dollars and Yuan are all in the same basketcase with each Central Bank playing a game of Mutually Assured Destruction (MAD) not seen since the days of Cold War. Hu Who wants to call Uno first? So far nobody. Man the lifeboats or go down together? So far the latter seems to be the choice. However, the natives are getting restless and as food and energy prices skyrocket, social unrest will become the norm.

Also out today, an excellent article (as always) on ZeroHedge is a must read on Pretend and Extend. If you don't inform yourself, the joke is on you.

And now, back to your regularly scheduled program...

It seems the Fukushima reactors are not the only things in Japan experiencing full meltdown. Reuters is reporting that Morgan Stanley is going to post a $1.7B loss for the year due to "bad bets." Guess Hu who will be picking up that tab if things turn sour? No worries. Printing presses are an amazing invention. Be sure to invest in ink and paper. They're going to need sinking boatloads. Titanic sized.

Speaking of boats, you may want to invest in a boat and flee to somewhere radioactive iodine and cesium 137 can't reach you, which according to the latest from Weather Online seems to be nowhere. The forecast for ground level cesium 137 is almost as alarming as the latest findings from the University of Nevada on soil samples taken from the base of the Sierra Nevada Mountains. You many want to put your sunglasses on when viewing the results. If true, Greece defaulting or the EU disintegrating over the weekend will be the least of our worries. This is now a global event on steroids. Xenon 133 for breakfast, anyone? Radioactive nucleotides are very dangerous to your health, no matter how many times you hear it's healthy for you.

It's good to know that there are citizens of this planet that do care about finding out the truth and informing others about the possible dangers. Forbes has a great article on citizens who are taking radiation monitoring into their own hands. After all, would you trust someone who claims to be a Nigerian prince with handling your bank account transactions?

Did you forget about Japan yet? TEPCO is sure hoping so, and just as expected, they are now releasing the real information that is both alarming yet obvious to those who have been keeping a tab on things over there. First up, TEPCO today admitted 520 tons of radioactive water leaked into the sea (not the 11 tons they initially stated). Be sure to read between the lines and then feel if your thyroid is swollen yet. Keep in mind, whatever official number they release, multiply that by a factor of 50 to get the more accurate figure.

Next up, TEPCO today admitted that the nuclear fuel "could be" melting "like lava." So, reading between the lines, nuclear fuel is melting, and has been melting for a long time. You can read more on ENE News.

Other than that, everything is just fine (and shiny). As a reminder, the markets are closed tomorrow and next week many global markets are on holiday schedule. If there is any big news to be announced, it probably will be announced at 3am on Sunday morning when everyone is sleeping. In the meantime, grab a good micro-brewed IPA beer from one of America's 1800 breweries and enjoy.

Note: Today's article includes many new developments on the critical situation in the EU and in particular, Greece. Scroll down to see updates.

Over a month ago, I discussed the outcome of the bailouts the European PIIGS started to receive in May of last year. In short, that final outcome would indeed involve a restructuring (read: default) of debt at some point in the very near future. The unsustainable bond yields at that time, prevented any of the peripheral members to go to the market for money. Further, as contagion spread rapidly from one member to another, it was clear to predict they would all fall like dominoes in a chain. All it would take is a spark; no shortage of sparks these days as sustained $100pb oil alone is enough to set the fragile economy into a tailspin and things are spiraling out of control rapidly. Consider:

Greek bonds quite literally exploded today, with the 10yr bond yielding a whopping 14.81% and the 2yr yielding an absolutely astronomical 22.03%! In layman's terms- a default is imminent. But the circus called the EU would not be quite the entertaining show it is without the stupendous theatrics from Finance Minister Papa Papaconstantinou, who obviously drinks too much ouzo before breakfast as his latest comedy hour press release states, "Greek debt is totally sustainable." Of course, the joke doesn't stop there. He adds, "Greece has ruled out restructuring" and "Greece plans to return to the debt markets by 2012." I must say, this is beyond incredible. Then again, one must remember that this comes from the same people that said a bailout was also out of the question - two days later, a bailout was requested.

The show is not over. With today's latest explosion in bond yields almost guaranteeing a restructuring (read: default) one can predict a minimum of a 40% haircut on GGB with the possibility of 70% not far away. Contagion will spread to the other PIIGS as well and despite Spain's "successful" bond auction today, the yields will continue to rise as the first four PIIGS have already passed a point of no return on the CDS spreads - the favorite, Greece CDS at 1820, Ireland at 690, Portugal at 650 and Spain at "just" 195. I say "just" because that is much lower than the other PIIGS, for now, but it is rising and closing in on the record set a few months ago. Only a matter of time before Spain CDS is above the magic 200. Needless to say, Spain's latest auction was spun as "successful," but only after the yield was pushed up to 5.47% to attract investors looking for a safer place to park their money compared to the other PIIGS (a fast peek at the markets show it's already rising from that level, so keep an eye on 5.55% level as that is a key technical level). Additionally, Spain needs to pay back $23Billion worth of bonds by the end of the month so they are in essences holding on by a toenail.

Speaking of toenails, as Greece inches closer to a total economic meltdown, so does their government as anarchy has broken out. Since Sunday the 17th of April, chaos has spread dramatically and the Police were forced to surrender two cities after 129 days of struggle with the people. This, coupled with a general strike on May 1st, is definitely bullish for the Greek economy and should be worth a few hundred points today on the DOW. Of course you know by now the DOW could go to 40k and it won't mean a thing (besides record bonuses to bankers), as all that matters is the value of your currency priced in gold and silver - two tangible items which can not be devalued by printing presses. A quick look at silver shows that shiny metal going parabolic. So is gold. So is oil. Great call by the team at Goldman Sachs, again... They wouldn't be Goldman if they weren't correct 150% of the time.

Wonder why gas is already $5.00 in our nation's capitol? Take a look at the value of the Yen, the Pound, the Euro, the US Dollar, the Canadian Dollar priced in gold and silver and that's why. On the current path, and with QE not ending anytime soon, here or in Europe, we can all expect to pay $5/gal gasoline in a few months even with demand dropping. Pure madness.

Which bring us back to Japan. The most important information to come out of Japan today again comes from the guys at ENE News. According to that report, radiation levels at reactor 2 are now thousands of times higher than troubled reactor 4, which means only one thing - the situation has crossed the point of no return. Already levels were too high for kamikazes workers to work and now, the gov't has decided to not even allow citizens to enter the 20km zone at all. More disturbing however, is news that radioactive iodine has been detected in breast milk from four women living just north of Tokyo. Wait a minute! A few weeks ago, Ann Coulter infamously said radiation is not only safe but even "healthy" for us. If what these bimbos experts on CNBS are telling us is true, then the small amounts of radiation should make their milk more healthy. You can't make this up.

In other news, Apple will try to herd the sheep with another distraction will ship out yet another new iPhone in September, meaning Apple has confirmed that the radioactive half life of their new product is but only a few weeks rather than months. The new iPhone4.2 is rumored to have at least two more cameras on each side, so you can view the world like a common house fly. It is also rumored to come with a built-in printing press for making your own fiat. Remember, more cameras are good; printing presses are better. You don't want to be caught dead with last month's model! Get in line now.

Finally, with all of the absurdly odd behavior around the world that is taking place, it seems as if we live in an utterly upside-down world from a 1980's sci-fi movie. One person recently stated "the situation in Japan has proven that when the authorities have no idea how to handle a catastrophic event because they know the world is doomed anyways, they pull a Fukushima. In 2008, we witnessed a financial Fukushima." As the old cliche goes, "Expect the unexpected."

Although the catastrophe in Japan is far from over - it's just getting started - it's a well established fact that humans tend to reach a point where they just would rather not hear anymore about an event; this is precisely what the Japanese gov't was counting on as they now begin to slowly release drips and drabs of critical information, such as TEPCO now admitting "there is little doubt plutonium has leaked from the plant." Questions arise now such as, where did it leak to and how much leaked? We may never no for sure but the impacts will be seen and felt shortly.

Not to be missed today is a new video from Fairewinds Associates Arnie Gundersen, who explains in detail what is still occurring. The good news is, reactor 3 seems to be stabilizing, but reactors 1, 2 and 4 are just heating up, quite literally. The most interesting aspect of the way he explains the situation is by breaking down the information TEPCO and the Japanese gov't publicly release, into easily digestible pieces and by using logic and science, shows why you're not getting the truth from them. Of course, this could be why Japan is moving to delete any information from the internet that exposes their lies goes against their policy and official news. And we thought internet censorship was only for hard line third world communist nations.

In a turning of the tables event, North Korean TV is reporting the seriousness of the radiation. A North Korean expert said, "What is most serious is that even a month after the accident, we see no prospects of getting radioactive leakages under control." For once, most of the world agrees.

Supply chain disruptions, which forced many plants around the world to shutdown, are still a big concern for the global economy and we expect to see the impact of those shutdown in the upcoming quarterly reports. The world's largest auto manufacture however, has restarted all factories in Japan once again albeit at 50% capacity. Toyota is projecting a production loss of 260,000 cars since then.

Of course, radioactive news about Japan isn't the only news that still makes tsunami waves. As Fukushima went critical in March, so did the European (Dis)Union as bond yields in the peripheral members went vertical. Greece, which has been insolvent since May of last year, has seen yields skyrocket. The 10yr exploded to almost 15% and the 3 month bond at auction went to the stratosphere - 4.1%. Needless to say, Portuguese bonds followed and the most critical 10yr bond now yields a completely unsustainable 9.31%. It's only a matter of time before Spain follows suit despite ECB intervention. Look for a Greek restructuring (read: default) in a month or two.

In sideshow news yesterday, the S&P cut the US debt outlook to negative and China warned the US to get its house in order or else. Again, pay no attention to the man behind the curtain.

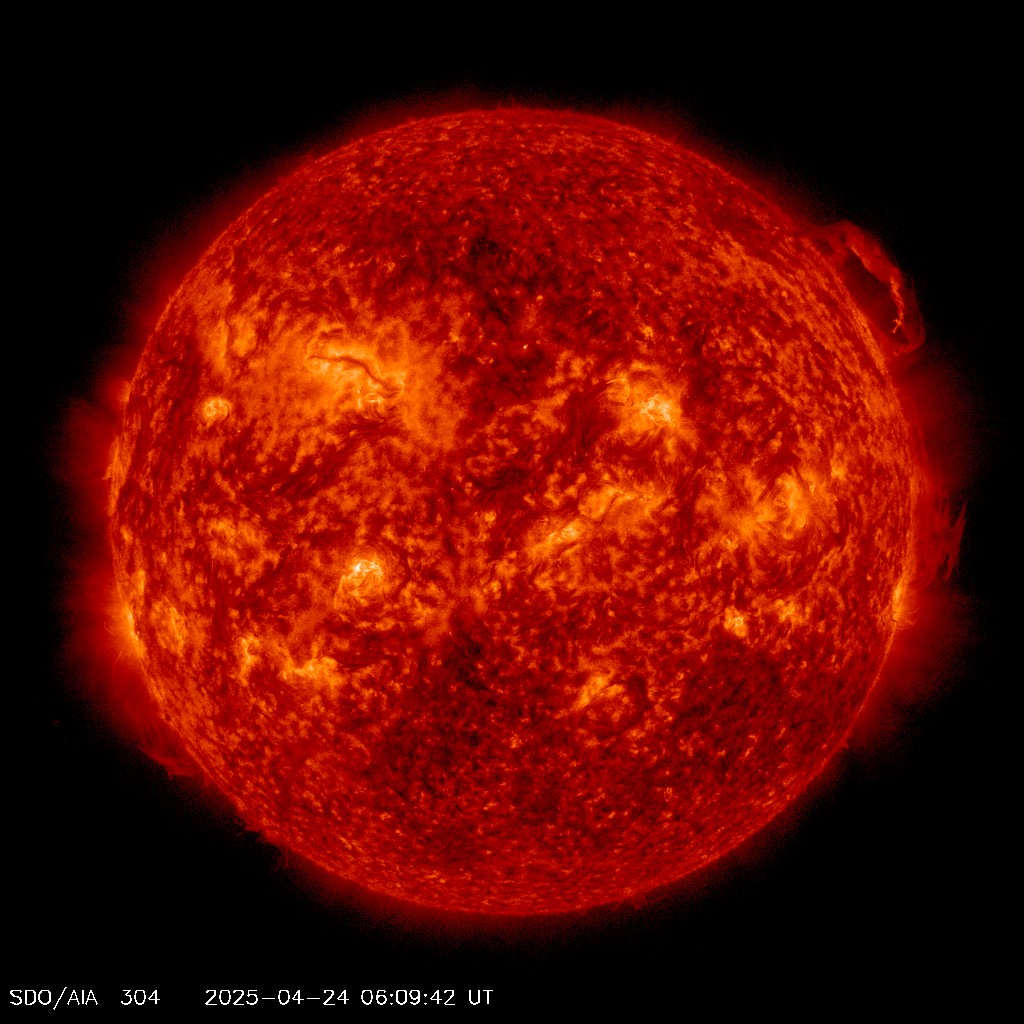

Speaking of curtain, Bloomberg is reporting that Dr. Deficit Bernanke will continue with QE to avoid "cold turkey." No surprises here. Quantitative Easing (aka money printing) will likely continue indefinitely. Even if a brief pause of QE takes places, it will begin again. After all, what else can the central banker of the world do for an unsustainable economy but print? Let's hope no more big earthquakes occur around the world, especially in the US - California is the most likely to be hit. The debt ceiling is already being knocked on as national debt is ebbing and flowing by a few billion dollars on a daily basis, but Hu who is counting? If the sun shoots off a mega X flare CME that is earth directed, an earthquake(s) of 9.0 magnitude can be expected for a certain. It may help to have a few extra gold/silver pieces in your pocket.

Nothing seems to surprise us anymore. Given the condition of the financial markets, it won't be a stretch of the imagination to say the end of traditional stock investing is over and done with for all eternity; ironically we think it has been dead since this so-called recession was officially declared over in June 2009. With that being said, today's (not so) shocker from the radioactive geniuses at the World Bank that the whole world is "one shock away from a full-blown crisis" is not only laughable, it's insulting to anyone with any intelligence whatsoever. If you need a good laugh to get your day started or to see how far behind the times they are, read that article from the BBC.

Interestingly, the people who run the University of Texas Investment Management Co., seem to be in step with reality and understand the full enormity of the global situation, as they have decided to take delivery of $1 Billion in gold bars and physically store them in a vault in NY. It seems they have figured out, when the SHTF worldwide, holding paper certs of gold or silver (or whatever asset) is as pointless as wearing a paint mask and sunglasses around reactor 3 in Fukushima. Taking physical delivery of silver and/or gold, is probably one of the smartest decisions holders of Euros/Dollars/Yen/Yuan et al, can make right now especially given the possibility of a shortage at the COMEX. "But I've got this paper here which says I own $40k in gold bullion!" Tough cookies!

Of course, the sovereign debt explosion (or rather implosion) isn't helping any. As reported here last week, Finland held a key election which has determined the fate of the entire EU. It turns out, the election yesterday went as we expected and right now, all future bailouts to Greece, Ireland and Portugal are in doubt - meaning, no more free soup for them. Of course Spain, like Portugal, like Greece and like Ireland, doesn't need a bailout, so there's nothing to worry about. Right?

Surprise, surprise - a quick glance at the Greek 10yr bond yield shows a whopping 14.69% and the 2yr bond is a radioactive 20.01%(!) on top of Portugal's 9.29% 10yr bond. Of course the PIIGS will all restructure their debt this is bullish for the global economy. We give the P, the first I and the G in PIIGS about a month before the real fireworks begin. By then, silver will be ~$50 and Fukushima will producing gold plated uranium pellets.

Speaking of Fukushima, TEPCO announced last night that they plan to reduce healthy radiation leaks in three months, and in nine months, cool the reactors. Well, that's a load of bull off our minds; it's good to know that they will at least reduce the rising radiation leaks in three months time since the most recent readings have increased 6 fold in just a matter of days. As we like to say, you can't make this up. Reality is stranger than fiction.

In other news, US debt was predictably downgraded by the S&P. Nothing to see here - move along.

Remember, $3.52 per gallon gasoline is not harmful to the US economy, but $4.00 is. And that's why the Exxon CEO gets paid the big bucks, to make pure genius revelations like that. Of course, now that 7 states are officially averaging $4.00 for regular and the national average is only 17 cents away from that beastly level, it's bullish for the global economy. All that demand from the red hot economy is putting more and more people into big gas guzzling SUV's and that is pushing the price of oil and gas higher. It's not the endless money printing. Because Dr. Deficit says so.

Updates

Update 1: Something from the realm of surreal turned bananas and which deserves an official "laugh out loud" moment is this Poll of Economists provided to us by the good people at AP. Enjoy, but be sure to sit down first.

Back in early March, before the catastrophe in Japan broke loose the gates of hell, back when there was other financial news, I wrote an article entitled "Greece Can't Seem To Catch a Break" in which I stated the inevitable outcome of all the PIIGS - the dreaded D word - Default. Basing the probability of restructuring (read: default) on CDS swaps spreads and bond yields at that time, I calculated there was a greater than 50% chance for a default. Looking at the most recent data yields us now with a greater than 60% chance on some back of the envelope math I like to run in my head. For example, the Greek 10yr bond is now yielding 13.31% and the 2yr bond, perhaps even more telling, is yielding 17.00%, making Greece the most risky nation in the world, more so than even Venezuela, Argentina, Kazakhstan and gasp! - Egypt. That deserves an ouzo! Or five.

While there is little to no chance the US will ever "default" per se (thanks in part to a wonderful invention called the printing press) that doesn't mean the whole scheme can't disintegrate overnight, especially when social unrest is sparked by grave injustices as this excellent article again by ZeroHedge so aptly highlights (Caution: Your blood may boil after reading this). Speaking of disintegration, if Spain is the next domino to fall, the whole EU experiment will fail, forcing the other members such as Germany and France to use another currency, which they do not want. In fact, Germany and France are enjoying the ride the PIIGS are providing; the PIIGS have bought them a little reprieve (and you haven't heard one word from Sarkozy about the Euro being too high). If Germany was using the Deutsch Mark, it would no doubt be trading at 2.50 DMUSD, killing off their exports. So despite all the theatrics in Germany about not giving another red cent to the PIIGS, we all know that it is in their best interests to keep the casino Euro going. Therefore, the ECB will simply continue to buy up all the bad debt to infinium, and pull a Dr. Deficit. Then again, Spain is Too Big To Save and if they "save" Greece, they create a moral hazard by obligating themselves to save Spain, and Portugal and Ireland and Italy. What a conundrum! To save, or not to save. That is the question.

As we all know by now, any and all catastrophes from henceforth will be solved with the printing of fiat money - Euros, Dollars, Yen et al. Something that can't simply be printed (and devalued), silver (and gold) continues to make new highs and traded above $42 for the first time in a very long time. It's now only $7 (and change) away from that infamous high. "To the moon, Alice!"

Of course, as we expected would happen, Japan doesn't want to release all of the news at once for fear of mass panic so everyday we get a little more of the reality of this situation. Today, we learn three important facts we already deduced - the melted fuel is sitting at the bottom of reactors, plutonium is being detected in soil samples and the fuel rods in reactors 1 and 2 were indeed exposed to air. Just think, all of this from just one article, more than a month later. Better late than never, as they say.

In other news, Morgan Stanley has failed to make a $3.3 Billion debt payment on some real estate and has handed the keys over to investors. Brings a whole new meaning to "jingle mail." Is Morgan Stanley the canary in the coal mine?

Interesting. Now, one month later, we start to get news from manufactures that have been radioactively impacted by the supply chain disruptions. Wait. We're confused. Isn't a catastrophe of epic proportions supposed to be bullish for the global economy, Warren et al? Can't wait to see the quarterly reports when they roll in.

Updates

Update 1: Keep your eyes this Sunday on Finland. If they vote against support of the PIIGS, the EU experiment is done. Gold and silver could make new highs.

Update 2: We all know surging food prices will bring out the worst in people. The New York Times is reporting vegetable bandits are getting serious. Only a matter of time before food prices here in the US lead to unrest and trafficking.

Oooooh! Look at the pretty picture! Who says you can't look at the sun? Keeping an eye on this big guy as he begins to heat up. More big earthquakes and/or volcanoes and/or strange weather on the way? Watch for solar flares (CME)...

As the catastrophe in Japan plays on, don't be surprised to see some very strange and otherwise useful information slowly being disseminated in drips and drabs from Japan. Take for example yesterday's revelation from Prime Minister Kan who was quoted as saying to an adviser "the evacuation zone around Fukushima will be uninhabitable," for quite possibly decades according to the Japanese newspaper Yomiuri. Now today, a European newspaper quoting sources from the ITAR-TASS is reporting Japan is "mulling moving the capitol from Tokyo" to possibly Osaka or Nagoya due to rising radiation levels and powerful earthquakes which continue to strike Japan. Which explains why world renowned Dr. Michio Kaku says in an excellent interview that his family is moving out of Tokyo and the people are "voting with their feet" by leaving voluntarily. If you haven't seen this interview, I suggest you take a few minutes and watch it through to the end.

Unless you don't drive or do your own food shopping, you already know that inflation is already here. The official numbers, which are not only based on outmoded calculation metrics but are obviously made to remove inflation, are far from reality. MIT has devised an excellent inflation metric called "The Billion Prices Project" which not only is updated often but it tracks inflation the way the average person feels it - in their wallet. We know those guys at MIT are purrrrrty smart guys so when they say annual inflation is at 10.5%, we know they are purrrrty close to the real figure.

In this tragic comedy we call a "global economy," we often see radioactive headlines like "JPMorgan Chase Earnings Up 67% On Economic Recovery" which are then countered with reality like unemployment going up, up and away. Just like anyone with half a radioactive brain knew March 12th that the evacuation zone in Japan would be rendered uninhabitable, we also know inflation is here and unemployment is getting worse, not better since June 2009 when this recession officially ended.

As reported here on Tuesday, Iceland voted by a wide margin not to pay back the banksters and cut loose the chains and risks a downgrade of their debt to junk status. As another article points out, "Iceland declared independence" with that vote. Keep an eye on that situation. And with your other eye, keep an eye on Greece which has seen bond yields explode over 13.2% last night as they lose grip on the situation. Even China the ECB can't save them now. Portugal is following in the footsteps of Greece and of course would not be a good follower without a general strike as the WSJ is reporting. Of course, the last time Portugal had a general strike, the entire country shut down. We're sure this is bullish for the global economy.

Main Article

As a change of pace, today's news won't begin with something relating to radiation or Japan or even earthquakes. Instead, we'll start with news thousands of miles away in the Middle East.

Exactly as expected, yesterday's ~4% drop in oil was only but a glitch. It was inevitable that some sort of "issue" would arise somewhere and true to its form, we get news overnight out of Kuwait that a sandstorm is to blame for their decision to halt oil exports which was enough to pop oil back off its lows and towards $107 again. Apparently, sandstorms are uncommon in a desert nation. Apparently, peace is also uncommon in the Mideast.

Moving onto news a few thousand miles to the west, but still pertinent to the entire global markets is a great article from John Hussman about the Federal Reserve pulling the rug out from the markets sooner than anyone thinks with the ending of QE2. He does make some valid points as to why they will end, but since the Federal Reserve's unofficial mandate is to pump up the markets, we don't think QE will end, if for at least three reasons. 1) According to the good Dr. Deficit and Co., inflation remains "tame" and that's code word for "too low for us," 2) the economic recovery that you are supposed to see and feel everywhere has still not materialized as unemployment remains very high and 3) needless to say, any future disasters whether natural or man made will be met with more of the same Quantitative Easing. Read though the Fed Minutes from last week and you'll notice the two main points are: QE will not end and QE will not end. Therefore we conclude, despite the rumors, QE will not end - debt ceiling, real inflation be darned.

Interestingly, as reported here shortly after the March 11th catastrophe, the main concern for the media was the economic impact, and they repeated that this disaster would cost Japan up to $300 billion, "making it the world's worst natural disaster." What exactly makes it the "worst natural disaster?" Oh, yes - the amount of money this will cost. Not the human cost such as the Indian Ocean Tsunami in 2004 which killed upwards of 300,000 people or the 200,000 lives lost in Haiti. Ok. We got it.

Since economics is the name of the game, it is interesting to note two related stories out today, one from the Japanese Finance Minister who once again reiterated the point that Japan's economy would slow down significantly (from already slow) and the other from an unlikely source in Germany - Dieter Zetsche of Daimler - who said that the March 11th catastrophe was "unlikely to deal a long term blow to the recovery." Which raises two questions for the good doctor: What recovery is he talking about and do supply chains mean anything? It's always nice to see people still drinking the Kool Aid and wearing rose colored glasses with all the doom and gloom green shoots.

Just as an example of how devastating the tsunami really was, a report from the Japan Times shows that more than 100 designated safe evacuation shelters were swept away or destroyed. The ironic part is, thousands of people fled to these safe shelters thinking they were safe and ended up losing their lives. To date, the total death toll stands at 27,000 is expect to rise.

Finally, two heartbreaking videos of the forgotten four legged animals of Fukushima. The first from CNN is a short video report on the dogs and cats roaming about and starving to death. The second is an amateur video showing hundreds of cattle still in their pens, many of them already dead from disease and starvation. We're sure this will be bullish for the global economy.

Updates

Update 10: RT is reporting news from environmental expert Christopher Busby says 400,000 people in a 200km radius will develop cancer. Words can not describe.

Update 9: Keep in mind, Treasury sold another $25B today at auction and is now $25B away from breaching the debt ceiling once again. Set your clocks.

Update 8: The cat is finally out of the bag. Japan's Prime Minister Kan, speaking to an adviser said "Evacuation zone will be uninhabitable" according to reports from Yomiuri. Now we know, there won't be too much economic growth from an area you can't use at all, a la Chernobyl. Amazing.

Update 7: ENE News Report a must see. Massive spike in radiation 100 miles from Fukushima after last weeks 7.4 massive aftershock earthquake.

Update 6: Greece hanging by a toenail, uses everything they've got to avoid a default. Iceland on the other hand rejects plan to repay Britain and Netherlands. Should be interesting to watch.

Update 5: Keep you eye on Unit 1 reactor as pressure rises to 1 Megapascal. As a reference, should be near zero level. Is it getting ready to blow? Excellent link shows temps and other variables.

Update 4: Alert: Radioactive Strontium Detected More Than 30km Away From Fukushima.

Update 3: New video from Fairewinds Arnie Gundersen on RT, says "Japanese government has downplayed the extent of the disaster" and is three weeks too late. Worst case scenario - "Fuel pool catches fire."

Update 2: The surreal just got even more so. As the only news source that matters, ZeroHedge is reporting, the "banks are about to get away Scott-Free" with a mass fraudclosure settlement to be announced shortly with no penalties. Too Big To Fail also now means Too Big To Be Held Accountable.

Update 1: Pay no attention to the PIIGS' rising bond yields. As reported yesterday, China is going to save the whole EU from implosion by simply buying up every bad debt, bank and asset in Spain. Today, the situation just got exponentially worse. Seems direct liquidity injections are necessary to keep the banks open.

By now, you are aware that market fundamentals no longer matter one iota as all news is good news for the markets, so let's get started with the only news that matters - radiation, Japan and earthquakes.

First, a must read from the New York Times. If you needed any more proof what a sham the scientific community has become nowadays, especially those guests you see invited on lame main stream media with their "radiation is good for you" propaganda, that article is it. As the reporter highlights in two separate interviews hundreds of miles apart, these shills experts are programmed to talk about bananas when the word radiation comes up in conversation.

Of course, the comedy tragedy [fill in the blank] doesn't stop just there. Remember the endless line of paid shills experts that were invited on nationally syndicated TV programs to talk about the positive economic impact this catastrophe will have on the global economy? Well, no surprise to readers of Fiat's Fire and ZeroHedge, officials are coming to terms with the situation we already knew about. As Reuters is reporting today, Japan's Economic Minister said the economic damage is "worse than first thought" and they are uncertain when all this rebuilding would begin to boost growth. We'll help you out - in the year 2025. Maybe. Maybe not. One wonders what their contingency plan is when 1/4 of Japan sinks into the ocean as this video shows possible liquefaction or possible shelf disconnection. We're not geology experts - we're financial cum radiation experts, so we can't say for sure what this is. You decide.

Hold that thought - whatever occurs, we already know what plan A is - print a few Trillion Yen. Plan B is more or less the same, but multiplied by a factor of 10. And so on and so forth, until a loaf of bread costs more than an iPad2. Which seems very likely given rising inflationary pressures worldwide and a report from the Japanese Meteorological Agency showing "the country's 20 volcanoes have "become alive due to the massive March 11 earthquake" and a "chain earthquake over 9.0-magnitude might hit Japan and its offshore area." We doubt things will start to settle down anytime soon, especially with the sun becoming very active recently.

Which brings us to a theory I proposed a while back that solar eruptions (CME) cause earthquakes here on earth. Indeed, as I predicted based on a solar storm last week, given the ~3 day time it takes for the energy to reach the earth, an earthquake of 6.0+ magnitude will occur sometime between the 8th and 13th; as of today, we've had 4 on what seems to be the weakest link in the chain. Perhaps space weather deserves a little spot on the 10 o'clock news after your normal weather forecast, so keep an eye (or two) on Yellowstone and California, both of which might become the next weakest link.

There is a bit of good news today however, and this comes without any extra implied sarcasm - oil is down almost 4% today. Not that you'll see it reflected at the pump anytime soon, but it's nice to know Goldman Sachs has a new entry point oil doesn't only go up all the time. Tomorrow, it'll be up again so enjoy the reprieve while you can. Did we mention that silver and gold are solid? Silver still above $40 and gold near highs.

Something that may or may not be news worthy today is China is saying they will continue to support Spain with further bond purchases. Of course, we know how well that worked out for Greece when China said the same exact thing last year. Speaking of Greece, taking a peek at Greece's financials, yields (no pun intended) us a view at a completely unsustainable 13%(!) 10 year bond yield. Of course, this doesn't mean a thing... besides indicating Greece is 100% insolvent and has been and will always be; the same of which can be said for Ireland, Portugal and dare we say, Spain.

Check back often for more updates.

Update 1: It looks like Japan is coming to reality with the situation ahead - Kyodo news is reporting "Japan may raise nuke accident severity level to highest 7 from 5." When they raise it that high, you know it's time to run to the hills.

Main Article

Shortly after the Fukushima catastrophe, certain so-called paid "experts" began showing up on various main stream media channels discussing how the US, and more specifically the West Coast, would not have to worry about radiation contamination saying somehow the radioactive isotopes of Cesium and Iodine would "dissipate" and have a "negligible" impact on human health (needless to mention other media circus clowns touting radiation as "healthy" for you). Today, CRIIRAD, a French radiation research institute published their findings on the so-called "negligible" radiation and the findings don't look good. Not only has radioactive iodine been detected across all parts of Europe, they recommend pregnant women and children "avoid consuming vegetables with large leaves, fresh milk and creamy cheese." There is no need to take iodine tablets just yet, but if certain Europeans on the other side of the Atlantic are being told to scratch dairy and green leafy vegetables off their menus, what should Americans who have received levels of radioactive iodine 131 that "are 8-10 times higher" than in Europe do? It's a must read article.

Another alarming study conducted by the Kyoto and Hiroshima Universities this week showed soil samples from more than 30 kilometers away from the Fukushima plant are as much as 400 times the normal levels of radiation. Samples from 5 different locations outside the 30 kilometer zone showed cesium 137 at levels "between about 590,000 and 2.19 million becquerels per cubic meter". For reference, residents who lived in areas surrounding Chernobyl where cesium 137 levels exceeded 555,000 becquerels per cubic meter were not permitted to stay. Perhaps this is why the Japanese gov't has just now increased the "danger zone" out to 30km. Why has it taken so long and why have they resisted expanding the zone? We wonder if it has anything to do with all those big factories, from Nissan to Panasonic being located there... say it ain't so!

The Fairewinds website which has become a staple around here, doesn't disappoint today with another excellent video from Arnie Gundersen demonstrating how the Fukushima fuel rods shattered and melted. Must watch if you're a science buff. Explains why radiation levels are so high and why Japanese officials are keeping quite. And here is a handy dandy geiger counter map keeping track of radiation across Japan.

Some time ago when I stumbled upon the NASA SOHO website, I conjured up a theory that our powerful sun, which has become very active recently and spews billions of tons of particle energy in the general direction of the earth, is responsible for earthquakes here on earth. Initiated by reader response in the comment section, I wrote last Friday that due to a recent coronal eruption on the sun, an earthquake greater than 6.0 magnitude should occur sometime between then (Friday April 8th) and Wednesday the 13th. Interestingly, we had two greater than 6.0 since then - a 6.1 on Saturday and 6.6 just today. Maybe there is something to this. I will try to update the CME of the sun and keep track of earthquakes here. Still waiting for the big one in California. Is this warning of an imminent big one?

In the meantime, keep your eyes on an imminent Greece debt restructuring. As I said with Portugal's bailout, it's only a matter of time. Even Spain, although officially "Too Big To Save," will be requesting a bailout very shortly - in as little as 1-3 months. Unsustainable bond yields equals bailout or bust. It is that simple. Of course, silver being at $42 now indicates more trouble ahead. We were joking about adding an extra zero to silver's $40 price target which was breached Friday, but at the same time, nothing these days surprises us anymore. Can't wait to see the next round of quarterly reports from all the big companies that rely on parts from Japan. Should be worth an extra 500 points on the DOW - which brings us back to a few articles we published over one month ago. One entitled "Think You're Paying Too Much At The Pump Now?" said you can expect to pay $3.80 a gallon for regular by April 1st. The same article showed our $40 silver target will be reached shortly by a $2 jump in the price of silver in a single day and a possible $50 target if things continued as they were - it did, they are, the economy is screwed. The second article, entitled "Painting The Global Economy Into The Corner" highlighted the problem Dr. Deficit created back in 2008 with his unofficial mandate of saving the stock market at all costs. In short, the good Doctor has but only a few weeks remaining before the coffee can he kicked down the road comes rolling back as a lead filled oil barrel. Have you ever painted yourself into a corner? Try it sometime, for fun.

Update 2: Freaky Friday: Oil about to break through $112 and close there. That explains why Silver Eagles are selling for $51 a pop on eBay. Or maybe the May 8th debt ceiling deadline?

Update 1: Radioactive mushrooms, strawberries are among 5 food items in California found to have Cesium 137. Just in case you didn't get the memo from Ann Coulter, Cesium 137 is one of those healthy radiations.

Main Article

Break out grandma's silverware! It was only a matter of time before the poor man's gold would hit our initial target of $40 set a while back (As an update, if conditions continue unabated, we will simply add a zero to the $40 and make our next target for silver $400. Only kidding... but are we really?)

Anyone with just half a radioactive brain knows when the Fed is pumping billions of fiat dollars into the stock markets on a daily basis to keep them afloat via POMO and the M1 monetary supply is on coarse course to break some sort of Weimar Republic record, all commodities and especially precious metals, will go ever higher. The inverse correlation to all of this means the purchasing power of the world's fiat currencies, from the US Dollar to the European Euro to the Japanese Yen will continue to decline. The most important metric a savvy investors needs to keep in mind is the price of gold and silver (tangible assets) price in fiat currencies. Remember, since that dark day in September 2008, it has been a race to devalue the fastest and no Central Bank is going to just sit back and watch their fiat currency go higher and higher. How can the average citizen protect himself from this madness? PM's of course.

With the war in Libya just beginning and the aforementioned inflationary pressures building, you can see why it will cost almost $90 to fill up your SUV next week. Recipe for $112 oil: combine war in Libya with endless printing of fiat, stir, blend with a dash of Middle East uprising, being careful not to add too much, and there you have WTI oil at $112. A delicious recipe, guaranteed to lower your caloric intake. Perhaps we can start a new fad diet and get Kim Kashmachine to sponsor it - we'll call it the Oil Diet. Every dollar higher the price of oil goes, your total intake drops by 25-30 calories. Next week, the recipe will change for sure and $120 WTI oil will be on the menu.

Oh, did we mention the black swans swarming overhead? That ingredient can be added to any recipe if one prefers to heat things up a bit. Think of a black swan as the Tabasco sauce used in a Bloody Mary. This week, black swans are the Chef's Special in Japan as Fukushima 2.0 in Onagawa begins to heat up. Oh, wait. You didn't see anything about that other nuclear plant leaking radioactive water on the 10 o'clock news? That's why they call it a black swan.

Remember in the days following the catastrophe in Japan when all the talking bimbos on CNBS and investors like Warren Buffet were saying that this event will somehow be bullish for the global economy and it will even jump start Japan's already dormant economy? Do you remember that? Of course you do. Surprise surprise! Today, the Japanese gov't issued a warning saying Japan's economy is in a "severe condition... with no quick recovery in sight." Now why on earth would they say that? Could it be the supply chain disruptions we discussed here weeks ago are starting to be felt globally? Could it be all the factories, not only in Japan but also around the world that are shutting down due to a lack of parts? Could it be power outages across Japan? Could it be the fishing industry being halted due to radiation? How about the hundreds of square kilometers of uninhabitable land where hundreds of thousands of people once worked and and lived? Could it be the droves of tourists fleeing the country? The list of is endless. Really then, what makes this catastrophe of epic proportions "bullish?"

The answer is the Keynesian unlimited printing of fiat money. That is it - which ironically brings us full circle to the rising commodity prices mentioned at the onset, which in turn brings more uprisings, which in turns brings more economic disruptions etc etc etc in an endless cycle. You can read more about this in detail in my article posted the week of March 7th.

To be fair however, Californians will be getting something out of this besides healthy iodine/xenon radiation - houses, cars, boats and shoes which are floating in a giant debris field and heading towards Kalifornia. Who knows what they'll find? Definitely not silver or gold.

And finally, two more tidbits of interest:

1- Oh, the drama! Government shutdown looms. Thousand of workers to celebrate with the purchases of new iPad2s.

2- Your favorite shopping malls may soon be closing as vacancy rates set to skyrocket. Definitely bullish for retails such as Abercrombie and Fitch which is at a 52 week high. With cotton at a record high and climbing, we wonder what super textile they use in place of cotton. Or are margins of no concern?

More updates soon.

Update 3: Onagawa plant loses 3 pumps for reactors.

Update 2: Just another day in the Middle East. War, bombings, suicide bombers. You know, the daily grind.

Update 1: A 7.4 Magnitude earthquake just struck off the coast of Japan. Tsunami warnings are in effect.

And a 6.7 in Veracruz Mexico. Ring of fire heating up?

Main Article:

The most important news I can bring to you today is, again from Japan. This time however, there is no "official" report from TEPCO. Instead, industry expert Arnie Gundersen reveals the inside scoop you don't know about. As he highlights in this special presentation, everyone from TEPCO to the Nuclear Industry are purposely "limiting the flow of information" but you already knew that. What you didn't know, like the reactors heating up to 5000 degrees Fahrenheit, of course, can't kill you. Right? Must watch.

Now, closely observe the radioactive cloud below and the path it takes. Notice South Korea.

Now you can see why over 130 schools across South Korea decided to close for the day as plumes of radioactive iodine 131 covered the peninsula and rain brought the iodine down to ground level. Of course, officials urged everyone to stay calm as the radioactive rain "poses no health threat." Perhaps kimchi has special radioactive resistant properties we don't know about?

With radioactive iodine now encircling the earth and falling as healthy radioactive rain, one can only ponder what the impact will be on the world's food supply and subsequent pricing. Thank goodness that the UN FAO Food report released today showed the March food price index dropped 2.9% after being up 37% YoY then (reader tip for report: read between the lines). We wouldn't want to see what impact $110 WTI oil and $122 Brent will have on food prices this month. But no worries here - this is bullish for stocks and simply part of the "wealth effect" the whole world is enjoying.

And then there is the little problem of what to do once the radiation readings here in the US start to creep up and creep out the people. According to a new report, the EPA supposedly has a plan to raise the acceptable levels of radiation, a la Japan. When all else fails, change the standards of what is safe, et voila! - the problem is solved.

What a difference a day makes when it comes to bailouts. As we expected, the louder a country denies (insert just about anything negative), the more likely it is true. In this case, Portugal denied to high heavens that they are in need of a bailout. It turns out, in less than 24 hours, a bailout was requested due to their debt spiraling out of control. No big surprise for savvy readers of blogs like this who knew that the Portuguese 10 year bond was yielding an unsustainable 8.90% and the 6 month bond was yielding a whopping 5.1%. As we posted the day before, it was only a matter of time before a bailout is requested. According to the initial request, $112 Billion is needed shortly, but the WSJ is reporting that they may need upwards of $129 Billion.We'll stick with the higher figure for now as everyone knows the PIIGS aren't called PIIGS for nothing - a bailout always precedes a bailout in an endless cycle. Case in point - Greece... and, now it looks like Ireland as well according to a former IMF director. But we already knew that as well, just as we know despite Spain denying any and all possible bailouts will need to be rescued. Give it a few months, tops.

World renowned investor and silver bug, Max Keiser said in a radio interview that $47 silver is the magic number needed to crash JP Morgan. With the silver spot at $39.59, Max is only $7.41 away from his lifetime dream. Stay tuned.

It may be pointless to even mention the Initial Claims data just released since you already know the data is revised on a weekly basis. The numbers are so well cooked, it would make Rachel Ray proud. Therefore, we suggest the "Ask Your Neighbors and Friends" metric for the best and most accurate unemployment data.

Finally, for those keeping track of the imminent gov't shutdown in less than 48 hours, it seems word about not collecting pay checks has already caused a stir. Protesters are out in force in several cities around the nation. You already know what we're thinking. (It's definitely bullish for stocks!)

More updates shortly.

Update 1: Saudi Arabia claims oil could hit $200-$300 pb on SA unrest. Definitely bullish for the global economy. There's nothing like skyrocketing energy prices to jump start the economic engine. Stay tuned.

Main Article:

Today's news begins with a short compilation of the good, the bad and the downright ugly, for which we have not just one single item to consider in that category and which will all be presented today with slightly lower levels of radiation sarcasm. First the "good."

Today, NHK World is reporting that TEPCO has plugged "the leak," or at least the one leak the whole world knows was leaking thousands of gallons of highly radioactive water into the sea from reactor 2. The question remains, how many more cracks are leaking radioactive water that they don't know about or know about but are not reporting? That's the good news. Now the bad.

According to a confidential assessment prepared by the US Nuclear Regulatory Commission and reported by The New York Times, there's a fresh wave of threats that could persist "indefinitely." As to the specific reason(s) they chose to use the word "indefinitely" in describing these threats, we can only speculate. Could it be that they have determined radioactive iodine 129, which is the byproduct of Plutonium and Uranium fission and which has a half life of 15 million years has leaked into the oceans and threatens the world's aquatic life? Or worse, perhaps Plutonium, Uranium and Cesium, each which have a much longer half life, have leaked into the oceans? That could have an indefinite impact on the earth for sure.

According to the same report, reactor number 1 likely has no cooling water whatsoever and any attempts to cool it further will be hindered by the salt building up on critical parts as reported here over a week ago. It's certainly an interesting read into the NRC's take on the situation, which differs greatly from the Japanese official reports.

Interestingly, the NRC report which shows that reactor number 1 has no water, could explain the reason TEPCO has announced they will attempt to inject nitrogen into this same reactor in an effort to prevent an imminent hydrogen explosion; of course, now that we are all nuclear experts thanks in part to Fukushima, we know hydrogen gas builds up when exposed rods melt and interact with other metals, releasing that highly explosive gas. It goes without saying, 1+1=2.

Another interesting tidbit of information that can be deduced using logic says, if radiation levels are so high that even sophisticated equipment has been rendered useless and are "immeasurable," how will human workers be able to come close enough to these structures in order to install proposed radiation shielding? Now we see why the earliest these shields can be installed is still 6 months away. Until then, the environment will continue to filled with healthy radiation.

Now that the "bad news" is out of the way, it's time for the "ugly news."

Is it just us, or does it seem like the global economy is coming to a screeching halt? Literally. With Toyota announcing North American production will be suspended due to a lack of parts, and now other manufactures around the world such as American Superconductor being decapitated as China's growth slows, we can see why super investors such as Warren Buffet are so bullish on the Japan catastrophe. It's interesting to note, AMSC got sliced on China's over stuffed inventory. Let's see how long it takes to reduce that inventory now.

Helping Japan's economy (and the global economy) during these black swan bullish events include, but are not limited to:

- India, China, others ban imports of food from Japan for at least three months

- Spain's unemployment jumps almost a full 1% to a record amount in March

- Portugal on the brink as bond yields explode to unsustainable levels (where have we seen this before? - Right. "We don't need no stinking bailout" Greece one year ago.)

- Greece on brink as they cry for help from EU

- Ireland sees a real run on banks and tries to stop it

- US mortgage applications drop 2% over week

- WTI oil now at $109 and climbing, gold at $1462, silver only 59 cents away from our initial price target of $40.

- Whoops! Health care costs for US citizens skyrocket 25-60% while top health care executives earn record bonuses - For example, United Health Care's CEO earned $102 Million in compensation in 2009, $1.7 Billion (Billion, no typo) in 2007, $125 Million in 2005 so on.

and last but not least

- US Gov't faces a shutdown in less than 72 hours. The clock's ticking.

Update 3: More information is being released on the radioactive fish found 100 miles away from the Fukushima plant. From the RSOE site: "Japan's Fisheries Ministry has found high levels of radioactive iodine and cesium in fish caught near the troubled Fukushima nuclear power plant, Kyodo news agency reported on Tuesday. One kilogram of young launce caught near the town of Kitaibaraki on the Ibaraki Prefecture on Monday contained 526 bequerels of radioactive cesium, 500 bequerels more than the legal limit, and 1,700 bequerels of iodine. The Ibaraki authorities urged people to stop eating fish."

Fishermen managed to take a picture of the strange fish before officials confiscated the evidence. Below is the image they managed to capture with their cell phone.

Update 2: FOMC Minutes released. The two key points, interrelated are: 1) QE will not end and 2) QE will not end. Any questions?

Update 1: Portuguese 10yr bond now yielding 8.89% and rising sharply. No need to mention that Spain is sure to follow. Might be a few weeks, but it's a given. Expect a bailout for Portugal shortly.

Main article-

It turns out that there is a mountain of pertinent news this morning, which under normal circumstances would definitely impact "the markets" or whatever you choose to call them now. Let's get started.

The news out of Japan today continues to flow like the radioactive water leaking into the Pacific Ocean from the Fukushima reactors and unlike the BP oil spill last year, this one will last more than 6 months. Count on that. Unfortunately, as expected, the news continues to be bad - CNN today is reporting that besides the 3 million gallons of radioactive water TEPCO has released into the Pacific Ocean as reported here yesterday, now they are admitting the levels of radioactivity in the water surrounding the Fukushima plant is 7.5 Million times the legal limit. Of course, they wouldn't release such information without the now company obligatory "don't worry it's still safe for life" tag attached to every single official press release. Needless to say, the official TEPCO assessment that "the spill might have a minimal effect on sealife," should be taken with a grain of radioactive salt.

It is very interesting to note that the Japanese gov't has set a new standard for radiation in fish now that last Friday, radioactive fish have been discovered off the coast of Japan. As The New York Times is reporting, this fish contained high levels of healthy radioactive iodine 131 that would make Ann Coulter proud.

Not to be missed is another TEPCO official crying crocodile tears as he publicly admits that the situation at the formerly stable reactors 5 & 6 has become critical as radioactive ground water has been discovered there as well. One can suppose, this is part of the reason Dr. Michio Kaku posted in his blog yesterday, "The situation at Fukushima is relatively stable now, in the same way that you are stable if you hang by your fingernails off a cliff, and your fingernails begin to break one by one...." [italics ours]

Certainly, all of this is bullish for the global economy as so many "experts" claim it is. Just ask Toyota, which is shuttering production in the US due to a lack of parts from Japan. Toyota officials claim this will "affect" 25,000 workers. How exactly this will "affect" these workers is yet to be seen but no doubt, these 25,000 workers will celebrate this sabbatical with the purchase of a new iPad2. Duh! #winning!

Since we're on the topic of unemployment, the Department of Numbers has a great breakdown of the demographics of the unemployed by various factors, provided by the good people at the B(L)S. It's official numbers they're working with so it must be accurate, right? Notice too, the B(L)S reporting that unemployment has fallen from 9.8% in November 2010 to just 8.9% in February 2011. In just 4 months time, the official unemployment rate has fallen nearly a full percentage point. This is especially amazing since the Food Stamp usage has gone up exponentially month over month and year over year since 2008. Could it be that less and less Americans are actually in the workforce? Read this excellent article from The Burning Platform and you be the judge.

Moving on along the same unemployment lines, perhaps you want to prepare for a US gov't shutdown this week. The Washington Post is reporting that the administration is preparing for a very real gov't shutdown if negotiations fall apart by midnight this Friday. We would have thought the deadline for this would be in a few weeks but then we realized American Idol is on this weekend and that is very important. Additionally, we can only imagine what "critical workers" are defined as. Will the streets by next week be filled with AK-47 toting Vietnam Vets wondering where their retirement checks are? We shall see.

A quick peek at "the markets" shows that they don't care about China raising its interest rate by 25 basis points which has pushed gold and silver to new highs as mentioned here a few weeks ago. Only $1 from our initial target of $40. As I said at the start, "under normal" conditions... which makes the Portuguese downgrade also moot. The Euro slips on the Portuguese dips, but what's in store for the other PIIGS? Bullish & Duh! #winning of course.

Of course, with all the mad men antics of endless fiat printing, one has to wonder what their next plan of action is if yet another major catastrophe occurs, such as a 9.5+ magnitude earthquake striking California which then unleashes a 100 foot tsunami on Asia. Simply throwing money at every disaster, whether natural or man made, does not seem like a viable solution. Indeed, it almost seems as if they know for a certain that some major earth changing catastrophe will take place sometime over the course of the next 1-18 months so what they are doing in the meantime is just buying time. Of course, this is pure speculation but nothing these days would surprise us.

Update 2: Pay no attention to surging wheat, oats, corn and oil prices. With WTI over $108 and knocking on $110 sooner than you can spell "quantitative easing," what's a few more uprisings around the world? Yes, it's also bullish for the "stock market" or whatever it has become. Rising food prices should also benefit the record 44.2 million Americans on food stamps. Print away.

Update 1: An EU official has just stated that they will not make any adjustments to the interest rate for Ireland from the EFSF. This supports the statement by another official a few hours ago that "Ireland's debt is Ireland's problem." In other words, the Irish Jig will need to be attempted with no legs.

Today's game: Guess this image.

Give up?

With all the comparisons of Fukushima and Chernobyl published on a daily basis these days, it's easy to forget, perhaps the most significant difference between the two - location. With Chernobyl being located hundreds of miles inland and away from any major source of water, and Fukushima being located directly on the shore of the Pacific Ocean, one has to ponder where will all of that radioactive water go and what will be the consequences on aquatic life. After all, millions of gallons of sea water were pumped onto the reactors in order to keep them cool for the past 3 weeks. It turns out, as expected, untold tens of thousands of gallons of highly radioactive water have leaked into the sea uncontrollably. Now, TEPCO has admitted this and has released pictures of the leak and their plans to correct this situation. Unfortunately, with plutonium's long half life, the damage is already done to the world's oceans. As CNN is reporting, TEPCO is rushing to "dump" 3 million gallons (11,500 tons) of radioactive water into the Pacific ocean, in a effort to advert an even worse catastrophe from occurring. In essence, they are replacing just radioactive water with highly radioactive water - or the lesser of two evils.

Needless to say, as reported here, they are simply buying time to gather the materials necessary for a Chernobyl like tomb. They can't keep workers there much longer with radiation now above 1 sievert per hour and now that other problems are arising. As can bee seen by these new high resolution photos, the plant can't be saved. It may be time to come up with a long term viable plan that can be accomplished quickly.

Now that you know radioactive particles will be encircling the globe shortly, here is what Pop Sci has published about radiation and its impact on the human body. Now remember, this article was published on the 16th of March and at that time, the readings were not much higher than 400 mSv/hour; they are currently above 1000 mSv/hour. We suppose despite this, Ann Coulter followers still believe radiation is healthy for you.

Moving on to other bullish news, Defense News is reporting that Sweden has approved the use of 8 of its jets for use in Libya to enforce the no-fly zone. Interestingly, this is the first time Sweden has become involved in a foreign war in 50 years. One has to ponder if this is strictly for humanitarian efforts or more is involved. Scratch that. We know - the future of delicious Swedish Fish are at stake.

Of course, we couldn't have another rally day for the DOW without more good reasons. Libya and Japan are reason enough to rally, right? Al Jazeera is reporting that hundreds of protesters in Yemen have been seriously injured from live rounds. This of course is the start of a wave of uprisings around the world and many more to come.

Since you are aware that the "recession" officially ended in June 2009, it might be good to take a look at the key driver of the US economy and its current condition. Perhaps this 60 Minutes presentation can provide some insight into the matter. If that video doesn't provide enough detail, then perhaps this CNN Money article which shows 11.4% of all US homes are vacant will. Should be bullish for home builders and the economy, no doubt.

Finally, we leave you with two interesting tidbits of information which you can use as you see fit:

1- "Genetically Modified Cows Produce Human Milk" is an interesting read into the world of playing God science.

2- Jobs are back! McDonald's is looking to fill 50k jobs nationwide on the 19th of April, so if you lost your regular full time job at a tax payer funded Too Big To Fail Bank or other Record Bonus Pay For Exec's Only Institution, you can always flip hamburgers for a living. Hu Who said all the jobs are going to China?